Physical Address

Indirizzo: Via Mario Greco 60, Buttigliera Alta, 10090, Torino, Italy

Physical Address

Indirizzo: Via Mario Greco 60, Buttigliera Alta, 10090, Torino, Italy

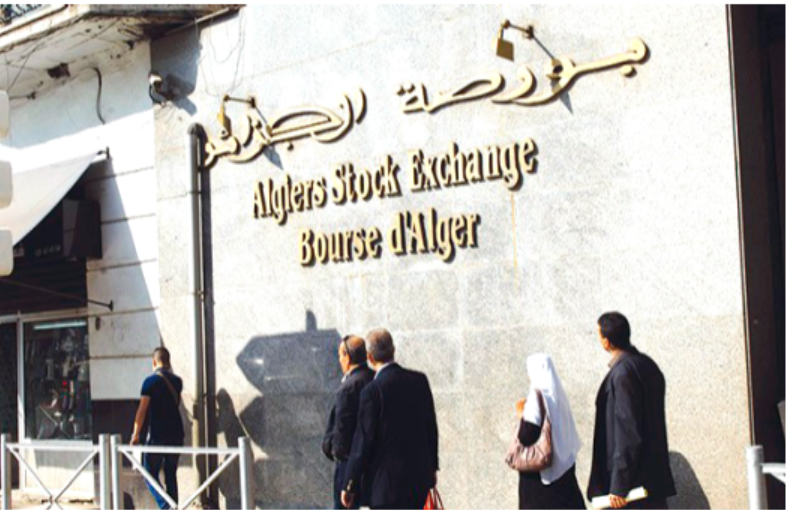

The president of the Commission for the organization and supervision of stock exchange operations (Cosob), Youcef Bouznada, announced on Sunday the commissioning of an electronic platform called “E-tawki3”, with a view to transfer orders for the sale and purchase of shares which were previously done in paper format to an electronic format. This allows, he indicated, investors to present their orders with ease and greater speed, through intermediaries in stock market operations, electronic banking services Ebanking, or through other applications, making it possible to facilitate the transaction operation, while saving them the need to travel to bank branches. It was during an official ceremony in the presence of the Advisor to the President of the Republic in charge of finance, banks, budget, foreign exchange reserves, public markets and international regulations, Mohamed Boukhari and the president of the National Economic Council , social and environmental (Cnese), Rabia Kherfi.

Youcef Bouznada announced that the launch of this platform in partnership with the Government Electronic Certification Authority (Agce) and with the contribution of the Association of Banks and Financial Institutions (Abef), with the aim of providing greater great dynamic to transactions on the national financial market, while improving the attractiveness of the latter, intervenes in accordance with the guidelines of the President of the Republic, Abdelmadjid Tebboune, aiming to generalize digitalization in all sectors, in particular those linked to financial services.

Affirming that this digital tool made available by the Agce, through a framework agreement defining the general framework for activating the digitization of stock market orders via the digital electronic signature platform for the benefit of approved stock market intermediaries , benefits from a set of strong instruments, for the elaboration of titles with ease and efficiency, just as it allows the establishment of qualified electronic signatures able to give electronic transactions an official character and to secure them

any further.

On another note, the president of Cosob indicated that the listing of the Local Development Bank (BDL) should take place before the end of the current year, while another public economic entity operating in the The telecoms sector has already started to prepare for it and three other companies have issued declarations of intent to integrate the new growth compartment of the Algiers stock market, reserved for SMEs and Start-ups. Welcoming, on the occasion, the successful entry of Crédit populaire d’Algérie (CPA) on the Algiers Stock Exchange, at the beginning of 2024.

Noting that Cosob recently received requests from three small and medium-sized enterprises (SMEs) expressing their intention to enter the stock market, the same source specified that the study of the files of these companies operating in the industrial sector was underway. . Announcing, on the occasion, the soon creation of a commission which will constitute a unique window for the financial market with a view to reducing time and effort and simplifying procedures for companies wishing to enter the stock market by allowing them to address to a single entity representing the stock market.

“A digital portal dedicated to the financial market will also be launched, before the end of the current year, allowing all requests from financial market operators to be submitted online, in addition to the launch of the new Cosob website,” a- he continued.

For his part, the Director General of Digitization, Digitalization and Economic Information Systems at the Ministry of Finance, Boudjemaâ Ghanem, indicated that the launch of this project is part of the continuation of the transformation process. digital transformation of the country and the development and modernization of the national financial market, with a view to boosting stock market transactions and reducing their costs for operators, whether individuals or businesses. Noting that the challenges to be met in this area concern in particular the revision of the legal and regulatory framework of the stock market in order to create an environment conducive to the growth and development of the financial industry in Algeria.

Rabah Mokhtari